Investing for Beginners :

Begin your investment journey in New Zealand with our comprehensive guide. Learn essential principles, strategies, and options for beginners. Unlock investment success now!

Investing for Beginners: Unlocking the Path to Financial Growth and Security

Investing plays a crucial role in achieving financial growth and security, particularly for beginners. It goes beyond simply saving money in a bank account and allows individuals to put their money to work and potentially earn returns that outpace inflation. By investing wisely, beginners have the opportunity to grow their wealth over time, meet their financial goals, and secure their future.

One of the primary reasons investing is important for beginners is the potential for higher returns compared to traditional savings methods. While savings accounts offer minimal interest rates, investments in various asset classes, such as stocks, bonds, and real estate, have historically provided higher returns over the long term. By learning about these investment options and making informed decisions, beginners can significantly increase their wealth and achieve their financial aspirations.

Furthermore, investing can act as a hedge against inflation, which erodes the purchasing power of money over time. By investing in assets that tend to outpace inflation, beginners can protect and grow their wealth in real terms.

Diversification is another key aspect of investing for beginners. By spreading investments across different asset classes and sectors, beginners can reduce the overall risk in their portfolio. This diversification helps mitigate potential losses from any single investment and provides a buffer against market volatility.

As beginners embark on their investment journey, it’s important to start with a solid foundation of investment knowledge. Understanding the different asset classes and their characteristics is crucial. Researching and learning about the risks and potential rewards associated with each investment option can help beginners make informed decisions.

Developing a clear understanding of financial goals, risk tolerance, and time horizon is essential for beginners. By aligning investments with their individual circumstances and objectives, beginners can create a suitable investment strategy.

Regular monitoring and review of investments is necessary for beginners. Keeping an eye on market trends, economic conditions, and any changes that may impact investment strategies is crucial. Periodic portfolio rebalancing ensures that the portfolio remains aligned with risk tolerance and investment objectives.

While investing offers the potential for significant returns, beginners should also be aware of the inherent risks. Prices of investments can fluctuate, and there is always the possibility of losses. Therefore, maintaining a long-term perspective and avoiding emotional decisions based on short-term market fluctuations are important for beginners.

Seeking professional advice can be valuable for beginners, especially as they gain more experience and their investment portfolio grows. Financial advisors can provide personalized guidance based on individual circumstances and goals.

Overview of the New Zealand Market and its Investment Opportunities

Investing for Beginners: Unlocking Opportunities in the New Zealand Market

New Zealand offers a dynamic and robust market for investors, characterized by various investment opportunities. The country has a stable and well-regulated financial system, making it an attractive destination for both domestic and international investors.

The New Zealand Stock Exchange (NZX) serves as the primary platform for trading equities, providing investors with access to a wide range of publicly listed companies. As a beginner investor, the stock market can be a rewarding avenue to participate in the growth of established corporations or support innovative startups.

In addition to the stock market, New Zealand offers opportunities in the bond market. Government bonds, known as New Zealand Government Stock (NZGS), provide a safe investment option backed by the government’s creditworthiness. These bonds offer stable returns and are suitable for conservative investors. Alternatively, corporate bonds issued by reputable companies offer attractive yields to investors seeking fixed-income instruments.

Real estate investment is another avenue with significant potential in New Zealand. The country’s property market has experienced substantial growth in recent years, driven by factors such as population growth, urbanization, and tourism. As a beginner investor, you can consider residential or commercial properties, taking advantage of rental income and capital appreciation.

Moreover, New Zealand provides a retirement savings scheme called KiwiSaver. This government-initiated program allows individuals to contribute a portion of their income to a KiwiSaver fund, which invests in various assets such as stocks, bonds, and cash. KiwiSaver offers a tax-efficient and accessible means for New Zealanders to save for retirement while benefiting from employer contributions and government incentives.

As a beginner investor, it is crucial to conduct thorough research, understand your risk tolerance, and set clear investment goals. Seek professional advice if needed and consider utilizing online brokerage platforms, financial news sources, and research tools to enhance your investment decisions. Regularly review and rebalance your investment portfolio to ensure alignment with your goals and market conditions.

Investing for beginners in the New Zealand market can be an exciting and rewarding journey. By capitalizing on the diverse investment opportunities available, you can build wealth and secure your financial future. Embrace the potential offered by the NZX, bond market, real estate, and the KiwiSaver program to embark on a successful investment venture in New Zealand.

II. Understanding Investment Basics

A. Definition of Investment and Its Objectives

Investment refers to the allocation of money, resources, or capital into assets or ventures with the expectation of generating income or appreciation over time. The primary objectives of investing are to preserve capital, grow wealth, and generate a return on investment.

Investors aim to achieve various financial goals through their investments, such as funding retirement, buying a home, starting a business, or simply building a financial safety net. By investing, individuals put their money to work to generate passive income, capital gains, or both, with the ultimate goal of achieving financial independence and long-term prosperity.

B. Risk and Return Trade-off

Investing involves a fundamental trade-off between risk and return. Generally, investments with higher potential returns tend to carry higher levels of risk. Risk refers to the uncertainty or possibility of losing some or all of the invested capital.

Different asset classes and investment options carry varying degrees of risk. Stocks, for example, are generally considered more volatile and carry a higher risk compared to bonds, which are generally considered more stable. Investors need to assess their risk tolerance, financial goals, and time horizon to determine the right balance between risk and potential returns.

It is important to note that risk is inherent in investing, and while higher-risk investments may offer greater potential rewards, they also come with an increased chance of loss. Investors should carefully evaluate and manage risk through diversification and other risk management strategies.

C. Time Horizon and Investment Goals

The time horizon refers to the length of time an investor is willing to hold an investment before needing to access the funds. The investment goals and time horizon are closely intertwined. Short-term goals, such as saving for a down payment on a house or funding a vacation, typically have a shorter time horizon and may require more conservative investment strategies.

On the other hand, long-term goals, such as retirement planning or funding a child’s education, have a longer time horizon. Longer time horizons allow investors to potentially take on more risk and benefit from the compounding of returns over time. This may involve investing in growth-oriented assets like stocks or real estate, which have historically offered higher returns but also higher volatility in the short term.

Understanding the time horizon is crucial as it helps determine the appropriate investment strategy, asset allocation, and risk tolerance for achieving specific goals.

D. Asset Classes and Their Characteristics

Investors can choose from various asset classes, each with its own characteristics and potential returns. Some common asset classes include:

1. Stocks and Equities: Stocks represent ownership in a company and offer the potential for capital appreciation and dividends. They tend to be more volatile but have historically provided higher long-term returns compared to other asset classes.

2. Bonds and Fixed-Income Securities: Bonds are debt instruments issued by governments or corporations. They provide fixed interest payments over a specified period and return the principal at maturity. Bonds are generally considered less risky than stocks and provide income through regular coupon payments.

3. Real Estate: Real estate investments involve purchasing properties for rental income or capital appreciation. Real estate can provide a stable income stream and potential tax benefits, along with the opportunity for long-term appreciation.

4. Mutual Funds and Exchange-Traded Funds (ETFs): Mutual funds and ETFs pool money from multiple investors to invest in a diversified portfolio of assets. They offer investors exposure to a wide range of securities or asset classes, providing diversification and professional management.

Understanding the characteristics of different asset classes helps investors make informed decisions about their investment portfolio allocation and risk management strategies.

By grasping these investment basics, individuals can establish a solid foundation for their investment journey and make educated decisions aligned with their financial goals, risk tolerance, and time horizon.

III. Setting Financial Goals and Assessing Risk Tolerance

A. Identifying Short-Term and Long-Term Financial Goals

Before diving into investments, it is essential to identify and prioritize your financial goals. Short-term goals typically span one to three years and may include saving for emergencies, paying off debt, or funding a vacation. Long-term goals, on the other hand, extend beyond three years and often involve retirement planning, purchasing a home, or funding a child’s education.

Take the time to evaluate your aspirations and create a comprehensive list of your financial goals. Quantify each goal by assigning a specific target amount and a timeline for achievement. Having clear objectives helps shape your investment strategy and guides your decision-making process.

B. Evaluating Risk Tolerance and Determining Risk Appetite

Risk tolerance refers to an investor’s ability to withstand fluctuations in the value of their investments without feeling undue stress or anxiety. It is influenced by various factors, including your financial situation, investment knowledge, time horizon, and personal comfort with volatility.

Assessing your risk tolerance is crucial as it helps determine the appropriate level of risk you can assume in your investment portfolio. It is important to strike a balance between risk and potential returns, ensuring that you can stay invested during market fluctuations without making impulsive decisions based on short-term market movements.

To evaluate your risk tolerance, consider the following:

1. Time Horizon: Longer time horizons generally allow for a higher risk tolerance as there is more time to recover from market downturns.

2. Financial Stability: Assess your financial situation, including income stability, liquidity needs, and existing financial commitments. A strong financial foundation can often support a higher risk tolerance.

3. Investment Knowledge: Consider your level of familiarity with different asset classes and investment strategies. The more you understand about investing, the better equipped you will be to evaluate and manage risk.

4. Emotional Response: Reflect on how you typically react to market fluctuations. Are you comfortable with volatility, or does it make you feel anxious? Understanding your emotional response can help gauge your risk tolerance.

C. Developing an Investment Strategy Based on Goals and Risk Tolerance

Once you have established your financial goals and assessed your risk tolerance, it is time to develop an investment strategy that aligns with both factors.

1. Asset Allocation: Determine the ideal allocation of your investment portfolio across different asset classes such as stocks, bonds, and real estate. Asset allocation is a crucial element in managing risk and potential returns. A more conservative investor may opt for a higher allocation in fixed-income assets, while a more aggressive investor may lean towards a higher allocation in equities.

2. Diversification: Spread your investments across different sectors, industries, and geographic regions. Diversification reduces the impact of any single investment on your portfolio’s overall performance. By diversifying, you can potentially minimize risk while capturing opportunities for growth.

3. Investment Vehicles: Choose suitable investment vehicles based on your goals and risk tolerance. These may include individual stocks, mutual funds, ETFs, or other investment instruments. Consider factors such as fees, liquidity, and historical performance when selecting investment vehicles.

4. Regular Monitoring and Rebalancing: Regularly review your portfolio’s performance and rebalance if necessary. As market conditions change, certain assets may outperform or underperform, leading to an imbalance in your asset allocation. Rebalancing involves selling over-performing assets and reinvesting in underperforming areas to maintain your desired asset allocation.

Remember, developing an investment strategy is an iterative process. It is important to periodically review and adjust your strategy as your financial goals, risk tolerance, or market conditions evolve.

By setting clear financial goals, evaluating risk tolerance, and developing a well-defined investment strategy, you lay the groundwork for a successful investment journey that aligns with your objectives and risk

IV. Investment Options in the New Zealand Market

A. Overview of the New Zealand Stock Exchange (NZX)

The New Zealand Stock Exchange (NZX) is the primary platform for trading equities and other securities in New Zealand. It provides investors with opportunities to invest in a wide range of publicly listed companies across various sectors of the economy. The NZX operates a well-regulated and transparent market, promoting investor confidence and facilitating capital formation.

B. Stock Market Investing

1. How to Research and Select Individual Stocks

– Fundamental Analysis: Analyze a company’s financial health, business model, competitive advantages, and management team to assess its investment potential.

– Technical Analysis: Study stock price patterns, trading volumes, and market trends to make investment decisions.

– Company News and Reports: Stay updated on company announcements, financial reports, and industry developments to make informed investment choices.

2. Understanding Stock Market Indices

– NZX 50: The NZX 50 Index represents the performance of the top 50 companies listed on the NZX. It serves as a benchmark for the overall New Zealand stock market.

– Sector Indices: Various sector-specific indices provide insights into the performance of specific industries such as finance, healthcare, technology, and energy.

3. Long-Term vs. Short-Term Stock Investing Strategies

– Long-term Investing: A strategy focused on buying and holding stocks for an extended period, typically aiming to benefit from the company’s growth prospects and potential dividend income.

– Short-term Trading: A strategy that involves buying and selling stocks within a short timeframe to capitalize on short-term price movements. Requires active monitoring and analysis of market trends.

C. Bond Market Investing

1. Types of Bonds Available in New Zealand

– Government Bonds (NZGS): Issued by the New Zealand government, these bonds are considered low-risk investments and offer regular interest payments.

– Corporate Bonds: Issued by companies to raise capital, corporate bonds offer higher yields than government bonds but also come with increased risk.

2. Evaluating Bond Risks and Yields

– Credit Risk: Assess the creditworthiness of the bond issuer by considering their financial health, credit ratings, and industry conditions.

– Interest Rate Risk: Understand how changes in interest rates can affect bond prices. Bond prices tend to decrease when interest rates rise and increase when rates fall.

– Yield to Maturity (YTM): Calculate the potential return on a bond if held until maturity, considering both interest payments and any capital gains or losses.

3. Government Bonds and Corporate Bonds

– Government Bonds: NZGS are considered safe investments due to the New Zealand government’s creditworthiness. They provide reliable interest income and return the principal at maturity.

– Corporate Bonds: Offered by companies, these bonds provide higher yields but come with higher credit risk. Investors should carefully analyze the issuing company’s financial health and industry conditions.

D. Real Estate Investing

1. Residential and Commercial Properties

– Residential Properties: Investing in residential real estate involves purchasing properties for rental income or potential capital appreciation. Factors to consider include location, property condition, rental demand, and local regulations.

– Commercial Properties: Investing in commercial real estate involves properties such as office buildings, retail spaces, and industrial properties. Commercial real estate can provide higher rental income but may require more substantial capital investment.

2. Factors to Consider When Investing in Real Estate

– Location: Choose properties in desirable locations with strong rental demand and potential for capital appreciation.

– Cash Flow Analysis: Evaluate the income generated from rental properties and compare it to expenses such as mortgage payments, maintenance costs, and property management fees.

– Market Research: Stay informed about local real estate market trends, supply and demand dynamics, and economic indicators that can influence property values and rental demand.

3. Real Estate Investment Trusts (REITs)

– REITs are investment vehicles that pool funds from multiple investors to invest in a portfolio of income-generating real estate properties.

– Investing in REITs offers diversification, liquidity, and the opportunity to participate in real estate returns without the need for direct property ownership.

– REITs can focus on various property types, such as residential, commercial, or industrial, allowing investors to choose based on their investment preferences.

E. KiwiSaver as a Retirement Investment Option

1. How KiwiSaver Works

– KiwiSaver is a voluntary retirement savings scheme in New Zealand, designed to help individuals save for their retirement.

– Contributions to KiwiSaver are made through regular deductions from your salary or voluntary contributions.

– The funds are invested in various asset classes, such as stocks, bonds, and cash, based on the chosen KiwiSaver fund.

2. Choosing the Right KiwiSaver Fund

– KiwiSaver funds offer different risk profiles and investment strategies. Consider your risk tolerance, time horizon, and investment goals when selecting a fund.

– Fund performance, fees, and the reputation of the fund manager are important factors to evaluate when choosing a KiwiSaver provider.

3. Maximizing KiwiSaver Contributions and Benefits

– Take advantage of employer contributions by contributing at least the minimum required percentage of your salary to KiwiSaver.

– Regularly review and assess your KiwiSaver contributions and investment options to ensure they align with your retirement goals.

– Understand the eligibility criteria for accessing KiwiSaver funds, which typically occurs at the age of 65 or under certain circumstances, such as buying your first home.

By understanding the investment options available in the New Zealand market, including stocks, bonds, real estate, and KiwiSaver, investors can make informed decisions that align with their financial goals, risk tolerance, and investment preferences. It is important to conduct thorough research, seek professional advice if needed, and regularly review and adjust your investment strategy as market conditions and personal circumstances change.

V. Building an Investment Portfolio

A. Diversification and Its Importance

Diversification is a risk management strategy that involves spreading investments across different asset classes, sectors, and geographic regions. It is a critical element in building an investment portfolio because it helps reduce risk and enhance potential returns.

Benefits of diversification:

1. Risk Reduction: Diversification minimizes the impact of any single investment’s performance on the overall portfolio. When one investment underperforms, other investments may offset the losses.

2. Exposure to Different Opportunities: By investing in various asset classes and sectors, you can capitalize on different market trends and economic conditions.

3. Smoothing Out Returns: Diversification can lead to a more stable and consistent portfolio performance over time, as different assets may have different return patterns.

4. Improved Risk-Return Profile: Diversification allows for a balance between risk and potential returns, optimizing the risk-return trade-off in your portfolio.

B. Asset Allocation Strategies

Asset allocation refers to the process of determining the optimal distribution of investments across different asset classes within a portfolio. The choice of asset allocation depends on your financial goals, risk tolerance, time horizon, and market conditions. Common asset classes include stocks, bonds, real estate, and cash.

Different asset allocation strategies include:

1. Strategic Asset Allocation: This strategy involves setting a target allocation for each asset class based on your long-term goals and risk tolerance. Regular rebalancing is required to maintain the desired asset mix.

2. Tactical Asset Allocation: This approach involves adjusting the portfolio’s asset allocation based on short-term market conditions or economic forecasts. It requires active monitoring and may involve higher transaction costs.

3. Balanced or Moderately Aggressive Allocation: This strategy aims to achieve a balance between risk and return by allocating a moderate percentage to stocks and a proportionate share to bonds and other asset classes.

4. Aggressive Allocation: This strategy involves a higher allocation to growth-oriented assets like stocks, aiming for higher potential returns but also exposing the portfolio to higher volatility.

C. Rebalancing and Monitoring Portfolio Performance

Regularly monitoring and rebalancing your portfolio is essential to maintain the desired asset allocation and risk level. Rebalancing involves buying or selling assets to restore the original target allocation.

Tips for portfolio monitoring and rebalancing:

1. Set a frequency for portfolio review based on your investment goals and market conditions.

2. Assess your portfolio’s performance relative to your objectives and make adjustments if needed.

3. Rebalance when the actual allocation deviates significantly from the target allocation or when market conditions warrant adjustments.

4. Consider tax implications, transaction costs, and any restrictions or fees associated with buying or selling assets.

D. Tax Implications and Considerations

Investors need to be aware of the tax implications of their investment activities. In New Zealand, some key considerations include:

1. Capital Gains Tax: Currently, New Zealand does not have a broad-based capital gains tax. However, some exceptions may apply, such as gains from property sales within certain timeframes.

2. Dividend Tax: Dividends received from New Zealand companies are subject to imputation credits, which may reduce the tax liability for individuals. Foreign dividends may be subject to withholding tax.

3. KiwiSaver Tax Benefits: Contributions to KiwiSaver are generally made on a pre-tax basis, which can provide tax advantages. However, withdrawals from KiwiSaver may be subject to tax depending on the circumstances.

4. Seek Professional Advice: Tax laws and regulations can be complex and subject to change. It is recommended to consult with a tax professional or financial advisor to ensure compliance and optimize tax efficiency within your investment strategy.

Understanding the tax implications of your investments is crucial for accurate financial planning and maximizing after-tax returns.

By focusing on diversification, asset allocation, rebalancing, and tax considerations, investors can effectively build a well-structured investment portfolio. Diversification helps mitigate risk by spreading investments across different assets, while asset allocation ensures alignment with individual goals and risk tolerance. Regular monitoring and rebalancing maintain the desired asset mix and optimize performance. Understanding the tax implications of investments helps manage tax liabilities and maximize after-tax returns.

It is important to note that investment decisions should be based on individual circumstances and goals. Considerations such as investment knowledge, time horizon, financial stability, and personal risk tolerance should guide the construction and management of an investment portfolio. Seeking professional advice from financial advisors or tax experts can provide valuable insights and ensure compliance with applicable regulations.

Building a successful investment portfolio requires diligence, ongoing evaluation, and adjustment. As market conditions change and personal circumstances evolve, periodically review and reassess your investment strategy. Stay informed about market trends, economic indicators, and new investment opportunities. By taking a disciplined and informed approach to portfolio construction, investors can work towards achieving their financial goals while managing risk effectively.

VI. Investment Strategies and Techniques

A. Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy where an investor regularly invests a fixed amount of money into a particular asset or portfolio at regular intervals, regardless of the asset’s price. This approach reduces the impact of market volatility on investment returns and can potentially lower the average cost per share over time. By consistently investing a fixed amount, more shares are purchased when prices are low and fewer shares when prices are high, averaging out the cost.

B. Value Investing

Value investing is an investment strategy that involves identifying undervalued securities in the market. Value investors seek opportunities where the intrinsic value of a security is higher than its current market price. They analyze fundamental factors such as company financials, earnings, assets, and market position to identify stocks that may be trading at a discount. The goal is to invest in these undervalued assets, holding them until the market recognizes their true value and prices adjust accordingly.

C. Growth Investing

Growth investing focuses on investing in companies with strong growth potential. Growth investors look for companies that are expected to experience above-average growth in earnings, revenue, or market share. They often prioritize companies in sectors such as technology, healthcare, or emerging industries. The goal is to capture the potential for capital appreciation as the company’s value increases over time.

D. Dividend Investing

Dividend investing involves investing in stocks or funds that provide regular dividend payments. Dividend payments are a portion of a company’s profits distributed to shareholders. Dividend investors seek companies with a history of stable or increasing dividends. This strategy aims to generate income from the dividend payments, potentially providing a steady stream of cash flow.

E. Index Investing and ETFs

Index investing involves investing in a portfolio that aims to replicate the performance of a specific market index, such as the NZX 50 Index. This strategy provides broad market exposure and diversification. Investors can achieve index investing through Exchange-Traded Funds (ETFs), which are investment funds traded on stock exchanges. ETFs offer the advantage of low costs, intraday trading flexibility, and diversification across multiple securities.

Benefits of index investing and ETFs:

1. Diversification: ETFs typically hold a basket of securities, providing exposure to a wide range of companies or assets.

2. Low Costs: ETFs often have lower expense ratios compared to actively managed funds.

3. Liquidity: ETFs trade on stock exchanges, allowing investors to buy or sell shares throughout the trading day.

4. Transparency: ETFs disclose their holdings regularly, enabling investors to monitor the underlying assets.

Investors should carefully consider their investment objectives, risk tolerance, and time horizon when choosing an investment strategy. It may be beneficial to combine different strategies or tailor them to individual needs. Understanding the characteristics and potential risks associated with each strategy is essential for making informed investment decisions.

VII. Risk Management and Investor Protection

A. Importance of Risk Management in Investing

Risk management is a critical aspect of investing that involves identifying, assessing, and mitigating potential risks. It helps investors protect their capital and make informed decisions based on their risk tolerance. Effective risk management strategies can help preserve investment returns and safeguard against unexpected losses.

Key considerations for risk management:

1. Diversification: Spreading investments across different asset classes, industries, and geographic regions can reduce the impact of any single investment’s performance on the overall portfolio.

2. Asset Allocation: Allocating investments based on risk tolerance and investment goals helps achieve a balanced and suitable portfolio.

3. Risk Assessment: Understanding the risks associated with different investments, such as market risk, credit risk, and liquidity risk, enables investors to make informed decisions.

4. Regular Monitoring: Continuously monitoring investment performance and market conditions allows for timely adjustments and risk mitigation strategies.

5. Stop Loss Orders: Setting stop loss orders can help limit potential losses by automatically selling an investment if it reaches a predetermined price.

B. Understanding Investment Scams and Frauds

Investors should be aware of investment scams and fraudulent activities that target unsuspecting individuals. Common investment scams include Ponzi schemes, pyramid schemes, and pump-and-dump schemes. These fraudulent schemes promise high returns with little risk but ultimately result in significant financial losses for investors.

Tips to protect against investment scams and frauds:

1. Conduct Due Diligence: Thoroughly research investment opportunities and companies before investing. Verify the credentials of individuals or firms offering investment products or services.

2. Be Wary of Unbelievable Returns: If an investment opportunity promises extraordinarily high returns with little or no risk, exercise caution and skepticism.

3. Check Regulatory Compliance: Ensure that investment products or advisors are registered with the appropriate regulatory authorities in New Zealand, such as the Financial Markets Authority (FMA).

4. Seek Professional Advice: Consult with a licensed financial advisor or investment professional to gain insights and guidance on investment decisions.

5. Report Suspicious Activities: If you come across a potential investment scam or fraudulent activity, report it to the relevant authorities, such as the FMA or the New Zealand Police.

C. Investor Protection Laws and Regulations in New Zealand

New Zealand has established investor protection laws and regulations to safeguard the interests of investors. The Financial Markets Conduct Act 2013 (FMCA) is a key legislation that sets out rules for offering and providing financial products and services. The FMCA aims to promote fair dealing, disclosure, and transparency in the financial markets.

Investor protection measures in New Zealand include:

1. Licensing and Registration: Financial service providers, including investment advisors, fund managers, and brokers, must be licensed and registered with the FMA.

2. Disclosure Requirements: Companies issuing financial products must provide accurate and comprehensive information to investors, including risks associated with the investment.

3. Dispute Resolution: New Zealand has a robust dispute resolution scheme, which provides a mechanism for resolving complaints and disputes between investors and financial service providers.

4. Market Monitoring: The FMA monitors financial markets and conducts investigations to detect and deter potential misconduct, ensuring fair and efficient markets.

It is important for investors to be aware of their rights, responsibilities, and the regulatory framework in place to protect them. Staying informed about investor protection laws and regulations can help investors make informed decisions and navigate the financial markets with confidence.

VIII. Investment Tools and Resources

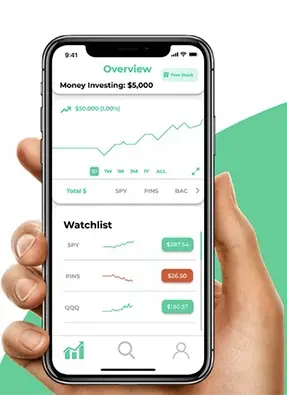

A. Online Brokerage Platforms

Online brokerage platforms provide a convenient and accessible way for investors to buy and sell securities in the financial markets. These platforms offer various features, including real-time market data, trading tools, and account management capabilities. They often provide a user-friendly interface and can be accessed via desktop or mobile devices.

Key features of online brokerage platforms:

1. Trading Functionality: Online brokers allow investors to place buy and sell orders for stocks, bonds, ETFs, and other securities.

2. Research and Analysis: Many platforms provide research tools, market analysis, and company information to help investors make informed investment decisions.

3. Account Management: Investors can monitor their investment portfolios, track performance, view transaction history, and access statements and tax documents.

4. Education and Support: Online brokers often offer educational resources, tutorials, and customer support to assist investors in navigating the platform and understanding investment concepts.

B. Financial News Sources and Research Tools

Staying informed about financial news and market trends is crucial for making informed investment decisions. Various financial news sources and research tools provide up-to-date information and analysis to help investors stay abreast of market developments.

Popular financial news sources and research tools include:

1. Financial Websites: Websites like Bloomberg, Reuters, and Yahoo Finance provide comprehensive financial news, analysis, and market data.

2. Economic Indicators: Government agencies and central banks release economic indicators and reports that provide insights into the overall economic health and trends.

3. Company Reports: Company websites, regulatory filings, and financial statements offer valuable information on the financial performance, strategies, and prospects of individual companies.

4. Analyst Reports: Research reports from investment banks, brokerage firms, and independent analysts provide in-depth analysis and recommendations on specific stocks or sectors.

C. Investment Calculators and Portfolio Trackers

Investment calculators and portfolio trackers are valuable tools for analyzing and monitoring investments. They assist in evaluating potential returns, assessing risk, and tracking portfolio performance.

Common investment calculators and portfolio trackers include:

1. Return Calculators: These tools help investors estimate potential investment returns based on historical performance, projected growth rates, and investment amounts.

2. Risk Assessment Tools: Risk calculators analyze investment portfolios to determine risk levels and measure potential losses under different market scenarios.

3. Asset Allocation Tools: These tools aid in determining the optimal allocation of investments across asset classes based on risk tolerance and investment goals.

4. Portfolio Trackers: Portfolio management tools allow investors to monitor their investments, track performance, and generate reports on asset allocation, diversification, and returns.

D. Seeking Professional Financial Advice

While investors can utilize various tools and resources, seeking professional financial advice can provide valuable insights and guidance. Financial advisors, wealth managers, and certified financial planners (CFPs) can offer personalized investment advice tailored to individual goals, risk tolerance, and financial circumstances.

Benefits of seeking professional financial advice:

1. Expertise and Knowledge: Financial professionals possess in-depth knowledge of investment strategies, market trends, and financial planning principles.

2. Personalized Guidance: Professionals can provide customized investment recommendations and help align investment strategies with specific financial goals.

3. Risk Management: Advisors can assess an investor’s risk tolerance and recommend suitable investment options to manage risk effectively.

4. Long-Term Planning: Professionals can assist in creating comprehensive financial plans, including retirement planning, tax optimization, and estate planning.

When seeking financial advice, ensure that the professional is qualified, reputable, and operates within regulatory frameworks. Consider their experience, certifications, fees, and alignment with your investment objectives.

Using these investment tools and resources can empower investors to make informed decisions, stay updated on market developments, and manage their investment portfolios effectively. Combining technology-driven tools with professional advice can enhance investment outcomes and help investors achieve their financial goals.

IX. Case Studies and Success Stories

A. Profiles of Successful Investors in the New Zealand Market

Examining the experiences and achievements of successful investors in the New Zealand market can provide valuable insights and inspiration for aspiring investors. Here are profiles of notable individuals who have achieved success through their investment journeys:

1. Sir Stephen Tindall: Sir Stephen Tindall is a prominent New Zealand entrepreneur and philanthropist. He co-founded The Warehouse Group, a successful retail chain, and later established the investment company, K1W1 Limited. Tindall is known for his long-term investment approach, focusing on supporting local businesses and fostering innovation.

2. Peter Beck: Peter Beck is the founder and CEO of Rocket Lab, a New Zealand-based aerospace company. Beck’s entrepreneurial journey involved securing significant investments to develop the company’s small satellite launch technology. Rocket Lab has successfully launched numerous commercial missions and has attracted substantial funding from global investors.

3. Sam Morgan: Sam Morgan is a New Zealand entrepreneur and angel investor, best known as the founder of Trade Me, an online auction and classifieds platform. Morgan’s investment journey began when he sold Trade Me to Fairfax Media and subsequently invested in various tech startups in New Zealand. He has played a crucial role in supporting the growth of New Zealand’s tech sector.

B. Lessons Learned from Their Investment Journeys

1. Long-Term Perspective: Successful investors emphasize the importance of having a long-term perspective. They understand that investment returns are not always immediate and that patience is key. By staying focused on their goals and making informed decisions, they have achieved significant success over time.

2. Identifying Opportunities: Successful investors possess a keen ability to identify investment opportunities early on. They carefully research industries, analyze market trends, and identify potential disruptors or growth areas. By staying ahead of the curve, they have been able to capitalize on emerging trends and achieve substantial returns.

3. Risk Management: Effective risk management is a crucial aspect of successful investing. The investors mentioned above have employed strategies to mitigate risks, such as diversifying their portfolios, conducting thorough due diligence, and seeking professional advice. They understand that risk and reward go hand in hand and take calculated risks based on their risk appetite.

4. Entrepreneurial Mindset: Many successful investors in the New Zealand market have an entrepreneurial mindset. They actively seek out innovative businesses, support local entrepreneurship, and invest in disruptive technologies. Their ability to spot opportunities and support entrepreneurial ventures has contributed to their investment success.

5. Giving Back: Successful investors often embrace philanthropy and give back to society. They recognize the importance of using their wealth and influence to make a positive impact. Through charitable initiatives, social investments, and mentoring programs, they contribute to the growth and development of the wider community.

By studying the investment journeys and strategies of successful investors in the New Zealand market, aspiring investors can gain valuable insights. They can learn the importance of a long-term perspective, identifying opportunities, effective risk management, maintaining an entrepreneurial mindset, and giving back to society. These lessons can guide individuals in their own investment journeys and increase their chances of achieving financial success.

X. Conclusion

A. Recap of Key Points

Throughout this article, we have explored the fundamentals of investing for beginners in the New Zealand market. We began by emphasizing the importance of investing for financial growth and security. We then provided an overview of the New Zealand market and its investment opportunities.

We discussed investment basics, including the definition of investment, the risk and return trade-off, time horizons, and asset classes. We delved into setting financial goals, assessing risk tolerance, and developing an investment strategy based on individual goals and risk appetite.

Next, we explored various investment options in the New Zealand market, such as stock market investing, bond market investing, real estate investing, and the KiwiSaver retirement investment option. We highlighted key considerations, strategies, and benefits associated with each investment avenue.

We discussed the importance of building an investment portfolio, including diversification, asset allocation, portfolio rebalancing, and tax implications. We explored different investment strategies and techniques, such as dollar-cost averaging, value investing, growth investing, dividend investing, index investing, and ETFs.

Furthermore, we emphasized the significance of risk management and investor protection. We discussed the importance of implementing risk management strategies, being aware of investment scams and frauds, and understanding investor protection laws and regulations in New Zealand.

We provided insights into investment tools and resources, including online brokerage platforms, financial news sources, research tools, investment calculators, portfolio trackers, and the option of seeking professional financial advice.

Lastly, we examined case studies and success stories of notable investors in the New Zealand market, drawing lessons from their investment journeys. We highlighted the importance of a long-term perspective, identifying opportunities, effective risk management, an entrepreneurial mindset, and giving back to society.

B. Encouragement for Beginners to Start Investing in the New Zealand Market

For beginners considering investing in the New Zealand market, now is an opportune time to start. The New Zealand market offers a range of investment opportunities across various asset classes, and the supportive regulatory framework provides investor protection.

Investing allows individuals to grow their wealth, achieve financial goals, and create a more secure future. By understanding the basics, setting clear goals, assessing risk tolerance, and developing an investment strategy, beginners can embark on their investment journey with confidence.

C. Final Words of Advice for Long-Term Investment Success

As you embark on your investment journey, it is important to remember a few key principles for long-term investment success:

1. Patience and Discipline: Investing is a long-term commitment. Remain patient and avoid making impulsive decisions based on short-term market fluctuations. Stick to your investment strategy and avoid emotional reactions.

2. Continual Learning: The investment landscape is constantly evolving. Stay informed by regularly educating yourself about market trends, investment strategies, and economic developments. Continual learning will help you make informed investment decisions.

3. Diversification and Asset Allocation: Diversify your portfolio across different asset classes to manage risk effectively. Set an appropriate asset allocation based on your risk tolerance and investment goals. Regularly rebalance your portfolio to maintain the desired allocation.

4. Regular Monitoring and Review: Monitor your investments regularly, keeping an eye on performance and market conditions. Review your investment strategy periodically to ensure alignment with your goals and make necessary adjustments as circumstances change.

5. Seek Professional Advice When Needed: Consider seeking professional financial advice, especially when dealing with complex investment options or significant financial decisions. A qualified financial advisor can provide personalized guidance based on your unique circumstances.

Remember, investing involves inherent risks, and past performance does not guarantee future results. Be cautious, stay informed, and make decisions based on careful analysis and consideration. By adopting a long-term perspective and following sound investment principles, you can increase your chances of achieving financial growth and security.

Happy investing in the New Zealand market!