Stock Investment

Stock investments can be a lucrative investment avenue for kiwis and a great way to diversify your investment portfolio. Several companies, and their stocks (shares of stock), are listed on the New Zealand stock exchange. These include a range of different types and industries of businesses. In this article, learn why you should consider stock investment in NZ and gain valuable tips to help you guide adequately.

STOCK INVESTMENT

The basics of what stock investment is all about in New Zealand. Stock Investment 101

Find out how beginners like you can start investing in Stock in New Zealand. Beginners Guide To Stock Investment

Find out why you should invest in stock in New Zealand. Stock Investment 2022

Find out how to start investing in stock from New Zealand. Its simpler than you think. Start Investing In Stock

Check out some of the best best apps and platforms to start investing in stocks from New Zealand. Best Stock Apps

Check out some of the main risk associated with stock investment in New Zealand. Risk Of Stock Investment

Stock Investing 101

Investing in the stock market is one way to grow your money. Stocks are part of a company and allow you to take part in that company’s success. Investing in stocks means you buy a “piece” of the company, also known as a “share” or “equity.” If the company succeeds and makes a profit, then so can you.

How does it work?

In New Zealand, stocks are bought and sold on the New Zealand Exchange(NZX).

When you buy or sell shares, you need to use a broker who will arrange for your purchase or sale. There are fees involved with this process that are based on a commission or brokerage fee, calculated as a percentage of the value of the transaction.

The NZX 50 index (also known as NZ50) is the main benchmark that tracks the performance of the top 50 stocks on the exchange. It measures roughly 85% of the total market capitalization in New Zealand.

Investing in Stocks for Beginners

Most people don’t buy stocks with the goal of holding them forever. Instead, they want to make money — and quick. But the best investments are those that meet your financial goals, whether that’s long-term growth or regular income.

If your goals include retiring early or paying for a child’s college education, then you may want to save and invest aggressively, depending on your age and risk tolerance.

If you’re new to investing in the stock market, you might be a little nervous about buying your first stock. It’s not as easy as buying something online with your credit card, but it’s also not nearly as difficult as you might think.

Investing in stocks is an excellent way to grow wealth. While there’s always a degree of risk, if you invest intelligently, you have the potential to make a lot of money. By choosing good stocks and holding them for the long term (3+ years), and by reinvesting dividends, you can amass significant wealth over time.

If you’re looking to invest in stocks, the best stocks for beginners with little money are those that pay dividends.

Dividend-paying stocks provide a regular income stream, which is a good strategy for beginning investors who don’t want to try their hand at stock picking.

It’s important to remember that investing in individual stocks is risky. While investment in just one company can turn out well, it’s much safer to diversify your money across multiple companies, sectors, and asset classes.

Why Invest in Stocks in 2022?

Through the ups and downs of the market, companies can continue to generate earnings, dividends, and capital growth for investors. Over time this can create a significant income stream and help you reach your financial goals. Here are some of the big reasons it’s worth adding shares to your portfolio:

Stock Market 2022

Potential for capital growth:

When you buy shares in a company, you’re buying into its future prospects. If the company performs well and its share price goes up (or sells more shares), then your investment will grow accordingly. This can happen over a period of weeks, months, years, or decades – there’s no fixed return on investment timeframe with shares.

Dividends:

Many companies pay out a portion of their profits to shareholders via dividends. These are usually paid quarterly or annually and generally increase over time as the company grows.

Dividends provide investors with regular income from their investments.

Liquidity:

Stocks are highly liquid assets that can be sold at any time during trading hours on a stock exchange (which can be up to 23 hours per day). This means that if you need cash, you can usually sell your stocks quickly for access to funds.

Portfolio Diversification:

There are different types of investments that offer varying levels of risk and return, so it’s generally recommended that investors have a mix of assets for optimum diversification (known as asset allocation). For example, you might have shares, domain names, fixed interest securities, property, and commodity investments all together in your portfolio.

How to invest in stocks and make money?

There are different ways to invest in stocks, but there is one way that works for most people. This method is called index fund investing and is worth a look if you’re considering investing in stocks.

You can think of an index fund as a basket containing all the stocks of a certain market. For example, if you want to buy all the stocks from the New Zealand market, then you can buy an NZX 50 index fund (which contains just 50 companies). You can also invest in other indexes, such as the S&P 500 or the Dow Jones Industrial Average (DJIA) if you like.

What does this mean for your portfolio?

It means that if you buy index funds on a regular basis, then you will be diversified across all of the companies in those markets. This means that if one company goes down, then another goes up, and it evens out over time.

You can also buy individual stocks of big companies on the stock exchange and hope that they rise. Or you can use a Robo-advisor to invest passively in a portfolio of stocks.

In New Zealand, we have a local stock market known as NZX. There are many companies listed on this exchange, including Air New Zealand, A2 Milk, Fletcher Building, and more. The local stock market makes it easier for investors to invest in KiwiSaver because most KiwiSaver funds allocate their money to the local stock market.

Another option is using an online brokerage firm that allows investors to trade international stocks and ETFs at a lower cost compared to buying from a bank or another financial institution. For example, Sharesies is one of the popular investing platforms that offers commission-free investing across multiple markets.

How to Get Started Investing in Stocks for Beginners

Do Your Research :

The first thing to do before investing in stocks is to do your research. You can do this by reading news and reports on the company, as well as reviewing their financial statements. This is crucial because it will give you a better understanding of the company and its fundamentals.

Alternatively, you can find an online broker that you can use to buy and sell shares. There are plenty of companies out there, so make sure you do your research before deciding which one is best for your needs. Once you have found a broker that suits your needs and budget, you can start investing in stocks!

Look for growth potential :

A good way of finding out how much potential a company has is by looking at its past performance. If you see that the business has been growing over time, it’s likely to continue doing so in future years, too — provided its competitive advantages remain intact!

Some of the best stocks are those with an established track record of growth over several years.

Know the Fees:

Make sure you know exactly how much the stockbroker charges for buying and selling shares. Some brokers charge a flat rate commission, while others charge a percentage of the value of the shares traded. Paying higher fees can erode your profit margin, so only consider brokers that charge a low commission rate.

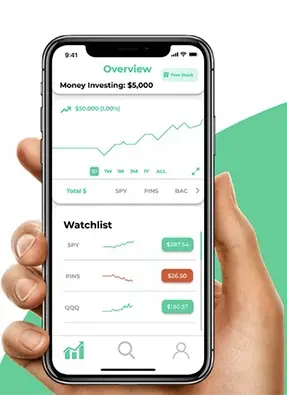

Global Best Stock Investment Apps

Once you’ve decided how to invest, it’s time to choose an app for your smartphone or tablet. Many people find that managing their investments on their mobile device is more convenient than logging into a website from their computer.

There are several investing apps that make it easy to start investing in stocks for beginners with little money. These apps let you invest in stocks online with minimal fees, minimal effort, and minimal prior knowledge. Here are some of our favorite investment apps:

Stash :

Stash is a micro-investing app that allows you to start with as little as $5. It’s best for investors who want to invest smaller amounts on a regular basis, but it also offers more traditional investments if you’re looking for something bigger.

TD Ameritrade Mobile :

This application is available on Apple and Android devices. The app offers a wide range of features, including the ability to place trades, manage your account balance and view real-time quotes. Users can also access research tools and market news. One of the best features of the TD Ameritrade app is that it allows users to set up watch lists, which they can monitor throughout the trading day. The app also provides charts that show current price changes. This information can be particularly helpful when evaluating whether you want to buy or sell stocks.

E*TRADE :

E*TRADE has been one of the biggest players in the online brokerage space for years; it was one of the first brokers to launch an iPhone app in 2008. Today it has expanded its offerings to include E*TRADE Mobile Pro (for active traders) and E*TRADE Mobile (for passive traders). Both offer advanced trading features as well as streaming quotes and quick access to trading tools like stock screeners, portfolio management tools, and watch lists.

Fidelity Investments :

The Fidelity app is available on both Apple and Android devices. This app allows you to view your account balances, monitor positions, and trade stocks. One of the most appealing features of this application is that it provides free webinars on investing topics and how to use Fidelity’s various features. You need a Fidelity account (brokerage, retirement, or other) to get started with investing in stocks for beginners.

Stock Investment Platforms In New Zealand

There are a few platforms available to Kiwis looking to start investing, and with the New Zealand budget announcement of a tax cut on some investments, it is looking more and more attractive. Here are a few platforms:

Sharesies

Sharesies is a micro-investing platform that allows you to invest in a number of companies listed on the NZX and ASX. The minimum investment is $5.00, and there is no monthly fee; however, there are brokerage fees. The great thing about this platform is that it allows you to invest in ETFs (Exchange Traded Funds).

Investnow

Investnow is a great option if you want a wide variety of funds available at your fingertips. There are over 60 different funds on this website which include domestic shares, bonds, cash, and exchange-traded funds (ETFs). You also have the choice to invest in international share funds such as Vanguard Australia or Vanguard US Total Market Shares Index Fund.

What are the Risks of Stock Investment?

There are several key risks to be aware of when investing in shares.

Credit risk – This is the risk that the company you have invested in will not be able to pay its bills on time or at all. If you hold shares in a company that goes into liquidation, then you may lose some or all of your investment.

Market risk – This is the risk that the market value of your investment may fall over time. Share prices can fluctuate throughout the year due to a number of reasons, including changes in interest rates, inflation, political and economic events, and any other news that affects how investors feel about the company’s prospects for future growth.

Liquidity risk – This is the risk that you may not be able to buy or sell shares quickly enough to take advantage of opportunities or protect yourself from potential loss.